The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

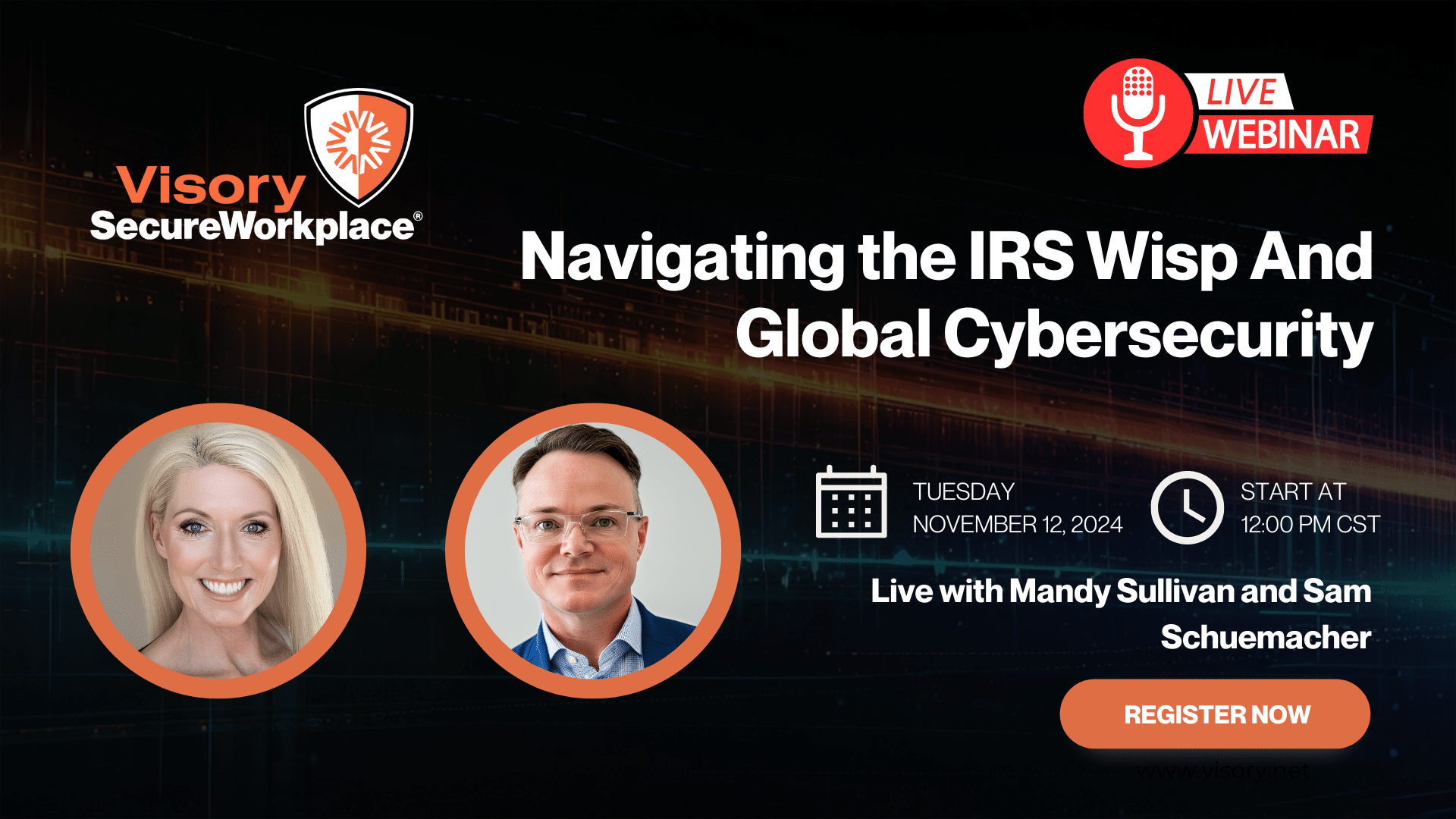

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

In 2023, the Federal Trade Commission (FTC) implemented a groundbreaking ruling known as the FTC Safeguards Rule. This rule is designed to enhance the security and privacy of sensitive consumer information held by businesses. An extension of the Gramm Leach Bliley Act, the rule was recently expanded to include non-banking financial institutions. While the ruling affects various industries, its impact on accountants and Certified Public Accountants (CPAs) is particularly significant.

Overview of the FTC Safeguards Rule:

The FTC Safeguards Rule establishes a framework for businesses to safeguard consumer data and protect it from unauthorized access, use, or disclosure. It requires covered entities to develop, implement and maintain comprehensive information security programs. The ruling applies to organizations that collect, store, process or transmit personal financial information about consumers.

Key Security Features Impacting Accountants:

Risk Assessment and Management:

- Designate a qualified individual or entity to implement and be in charge of your security program

- Conduct thorough risk assessments to identify potential vulnerabilities in their data systems.

- Implement risk management strategies to mitigate identified risks effectively.

- Implement regular risk assessments and updates to security protocols.

Encryption and Data Protection:

- Implement robust encryption measures for both data in transit and data at rest.

- Utilize strong encryption algorithms and secure key management systems to prevent unauthorized access.

Access Controls:

- Mandate multi-factor authentication (MFA) to prevent unauthorized access.

- Establish role-based access controls to ensure that employees have access only to the data they need to perform their duties.

Incident Response and Data Breach Notification:

- Develop a well-defined incident response plan to address potential data breaches promptly.

- Establish procedures for investigating and remediating security incidents, including notifying affected individuals and appropriate authorities as required.

- Develop procedures to report data breaches to affected consumers in a timely manner.

Employee Training and Awareness:

- Provide comprehensive training programs to educate your staff about security threats, data handling procedures, and the importance of confidentiality.

- Employee training must be ongoing to help create a culture of data security within the organization.

How does Swizznet help you comply with the FTC Safeguard Policy?

Swizznet offers comprehensive IT solutions where security and peace of mind go hand in hand. We ensure that your valuable data is safeguarded while enjoying uninterrupted productivity. Our dedicated team of experts works tirelessly to provide Visory’s Secure Office Solution, a comprehensive suite of services covering all aspects of your IT infrastructure. Experience the confidence that comes with a truly holistic IT solution, where security and support are seamlessly integrated to propel your business forward.

The 2023 FTC Safeguards Rule brings significant changes to the way accountants and CPAs handle consumer data. Compliance with the ruling requires accountants to develop and maintain robust information security programs, implement encryption and access controls, and establish incident response plans, plus a robust employee training and awareness plan.

Visory’s Secure Office Solution can help position your business for growth by securing your critical customer data and also meet the requirements of the Safeguards Rule.

Compliance

Our team of professionals has the right expertise to ensure your technology and cybersecurity complies with the strictest guidance and passes regulatory muster.

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms