The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

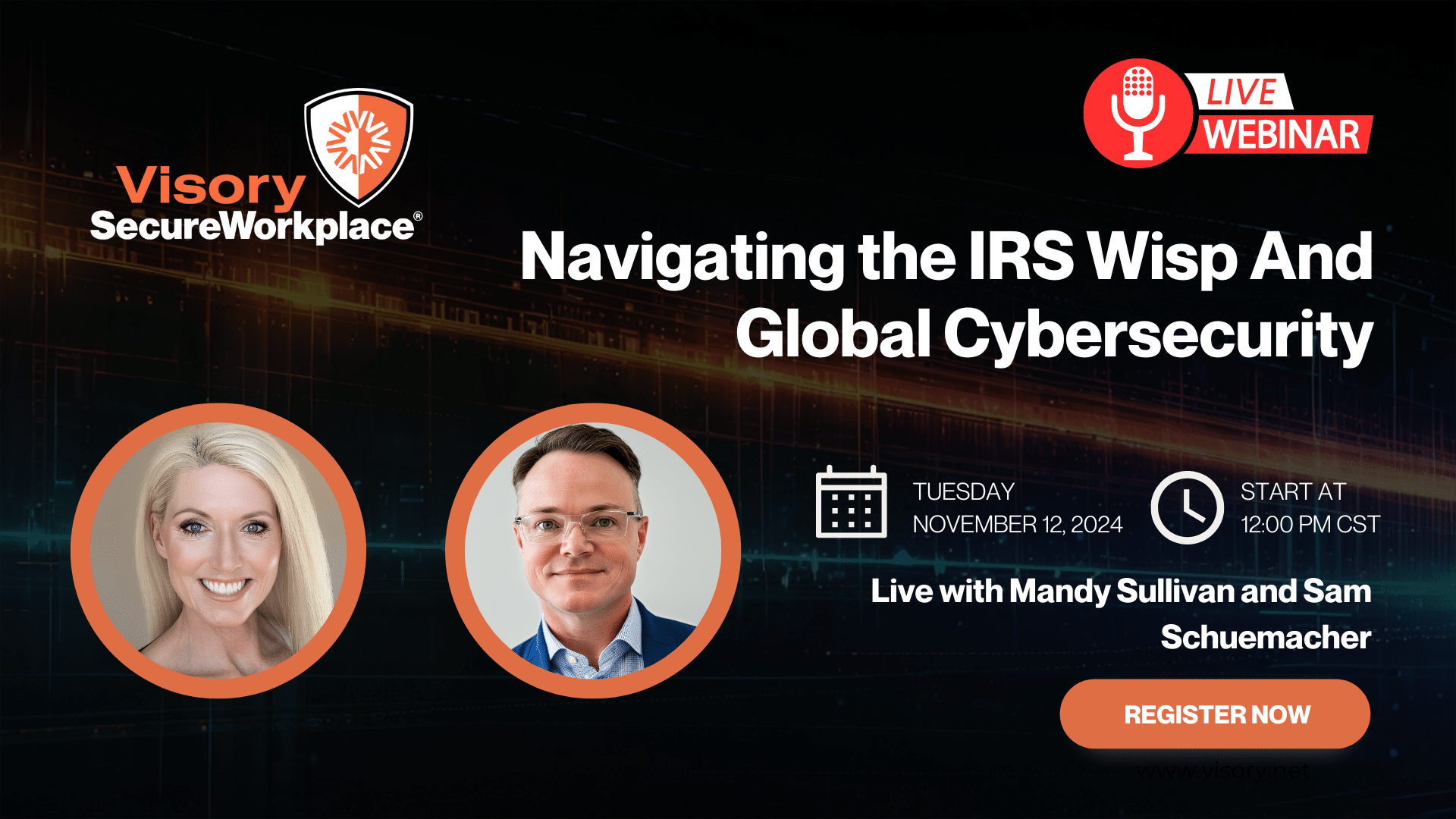

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

With all the news about accounting cybersecurity threats, there’s another angle that’s less talked about: the opportunity these breaches create for CPAs and accountants. Clients increasingly see accountants as trusted advisors for all aspects of finance. By developing a comprehensive security plan, you’ll increase the value you bring to your relationship with clients.

The situation may sound overwhelming. The list of threats is endless. Ransomware. Password guessing software. Vulnerable technology. Public WiFi. Phishing attacks. Thankfully, you don’t need to be a cybersecurity whiz with three Ph.D.’s to protect your firm and your clients. Those security geniuses are busy around the clock. You can leverage their work to build a practical but effective security program for your accounting team or CPA firm.

The IRS released a six-step guide for accounting cybersecurity. Let’s explore these steps and learn some practical ways you can protect your firm and your clients in the coming months and years.

1) Install and Update Antivirus Software that Scans Files and Memory for Malware

The IRS requires malware protection on any system that stores, processes, or transmits Federal Tax Information. While the IRS does not mandate any specific malware/virus detection software, it has approved Symantec Antivirus for use on Windows systems internal to the IRS. Be sure to set it up to automatically update so you have the most current protection at all times.

2) Use Firewalls to Shield Your Computer or Network from Malicious Traffic or Malware

Firewalls come in two broad categories: hardware and software. Hardware firewalls are physical devices that can be integrated on home or office routers. Some internet service providers (ISPs) offer these directly, or they can be purchased through a vendor. Firewall software typically comes with operating systems or can be downloaded from a reputable website. Both types of firewalls help prevent unauthorized access to computers, but they cannot protect data in case a user downloads malware through a phishing attack.

3) Use Two-Factor Authentication to Secure Email, Accounting Software, or Any Password-Protected Product

Accounting professionals should always use two-factor authentication when it’s available. Two-factor authentication requires both a user name and password, and a second authentication method sent by text or through an app. Bad actors may uncover your username and password, and can spoof your mobile phone texts, but it’s nearly impossible for them to breach both these technologies at the same time.

4) Routinely Backup Critical Files to a Secure External Hard Drive or Cloud Storage Service

It may seem counterintuitive to create an additional copy of the data you’re trying to protect, but the public cloud providers like Microsoft and Google have tens of thousands of security professionals working to secure that data. As long as you upload the data through a secure connection, it’s relatively safe in a public cloud environment. The point is if something happens to your business-critical data, such as losing a computer, human error, or something more malicious, you’ll have a copy of the data that’s secure and can be restored.

5) Encrypt Files on Computers and Removable Media

Some accountants and CPAs believe encryption is too complicated or that an attack won’t happen to them. However, even the smallest accounting firms store sensitive data like social security numbers and bank account information, so they are attractive targets for cybercriminals who can sell this information on the black market. Ensure your data is encrypted both where it’s stored and when it’s transmitted across a network.

6) Write Down Your Data Security Plan as Required by the Federal Trade Commission’s Safeguards Rule 5

A comprehensive security plan includes the security measures you’ll be implementing within your organization. Perhaps more importantly, it includes a playbook for the role everyone in the organization plays in security. At the least, an accounting data security plan should account for how you’ll educate team members about the methods used by hackers to breach data as well as security best practices for counteracting these threats.

Closing Thoughts on Accounting Cybersecurity

This talk about data breaches and ransomware attacks can seem overwhelming — after all, you want to focus on helping clients and growing your business. But cyber threats aren’t going away, so it’s helpful to reframe this as part of your fiduciary responsibility to your clients. They come to you, after all, because they want to focus on the core aspects of their own businesses or personal lives. So think of cybersecurity as another way to serve your clients beyond just number crunching.

Interested in learning more about accounting cybersecurity threats, and how you can respond? Read our guidebook, The Security Threats Facing Accountants, CPAs, and Bookkeepers in 2021.

Compliance

Our team of professionals has the right expertise to ensure your technology and cybersecurity complies with the strictest guidance and passes regulatory muster.

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms