The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

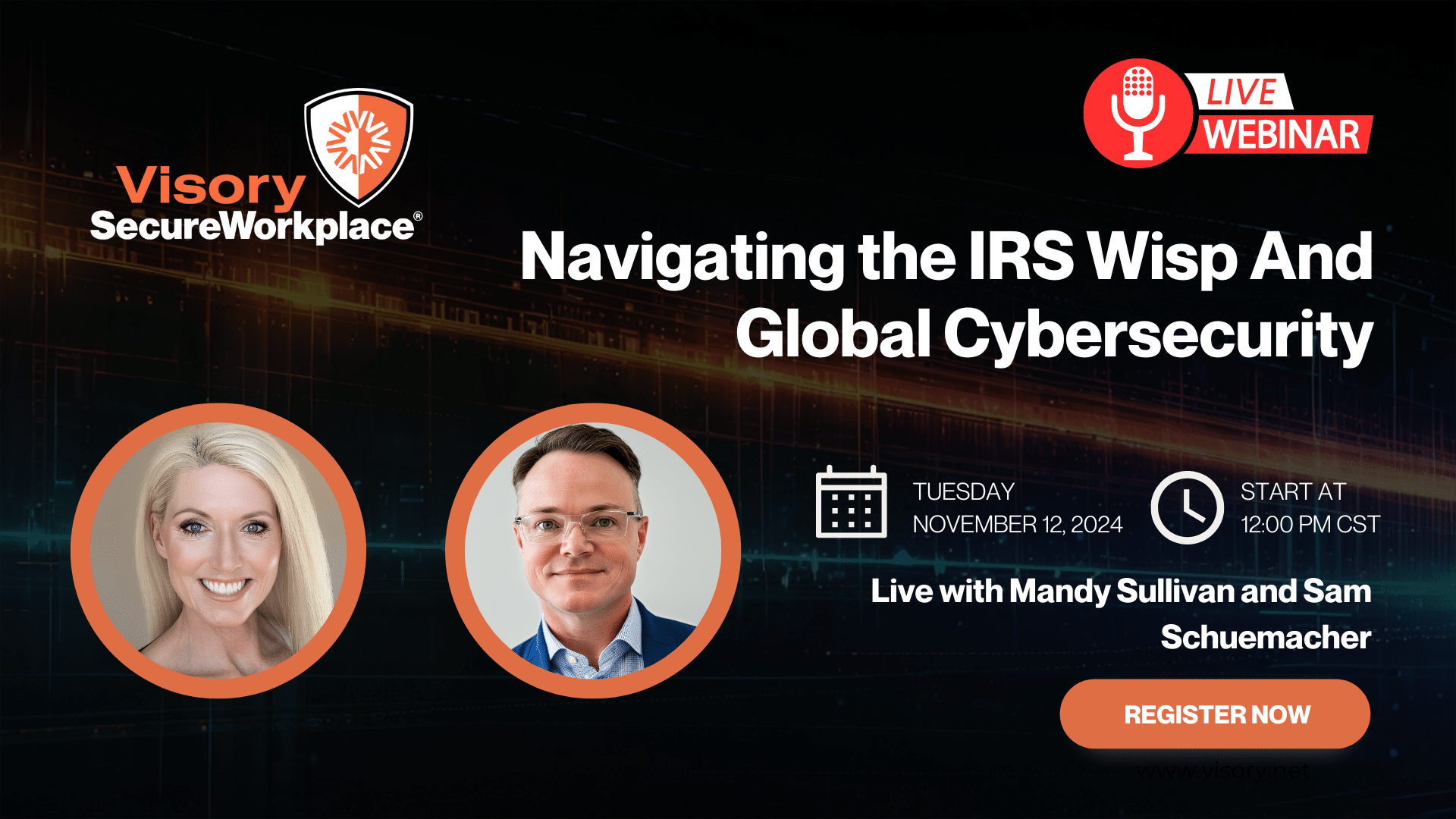

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

By Wes Stillman, President of RightSize Solutions

We made it to 2021, so what’s next? It’s clear that some of the operational and technology shifts that RIAs made in 2020 are here to stay, and more changes may be on their way.

At the beginning of the Covid-19 pandemic, many of you seamlessly adapted to a (largely) remote work model with barely a hiccup. Now it’s 2021, and you’re continuing with remote work at some level and plan on serving clients and managing your businesses this way for the foreseeable future. Thanks to technology, an interim workplace solution has become the preferred permanent one for you and for many of your clients.

Understanding that remote work is more normalized than ever for RIAs and your clients, firm owners should consider the following actions in 2021:

Revisit your remote policies. This one should be fairly evident, but it bears repeating. In this era of remote work, mobile devices are becoming a default choice for getting work done. And why not? The idea of being able to use that device – say it’s your phone – for email or communication, or to grab a file quickly and send it off to a client, is extremely appealing.

Still, RIAs must stay in compliance with regulatory guidance on technology and cybersecurity management. So we can’t simply ignore the increased security issues come with mobile devices – they are broken into more easily, which increases your firm’s susceptibility of being hacked.

So if you haven’t done so already, do a quick audit of how your remote work policies are being implemented. You need to make sure that your providers really are enforcing that policy.

To better ensure data protection and security, RIAs can also consider buying firm-owned and managed mobile devices for staff to use, but this isn’t always the best solution and it’s certainly not the most convenient for staff. The other option is to secure personal devices. Microsoft and a few others have done a good job of partitioning off devices so that an employer can manage the applications and the data associated with the business, and the individual can use their personal device without feeling like Big Brother is looking over their shoulder.

Integrate the fintech and tech stacks. This was a hot topic for advisors in 2020, as they worked to keep their operations and data secure while going remote, and we expect more of the same for 2021. RIAs need a single place – a point of truth, let’s call it – from which all their information flows to the fintech stack and between applications. This type of deep integration also enables firms to simplify identity management, that is, end user and end client identification and authentication, through the fintech stack. Or say you want to move from one CRM to another. That’s typically a big project, but we’re seeing tools on the horizon that rely on a single point of truth and deep integration to help simplify this as well.

So, we’re excited about the prospects offered by integration. We think it gives RIAs the opportunity to streamline operations and improve workflows without necessarily needing to expand head count.

Increase your tech stack spend. Take a deep breath and let’s walk through this. We typically see RIAs allocate one percent of their annual gross revenues to their technology spend. This budget is mostly allocated to the firm’s fintech stack – that is, your core advisor tools and applications – but anywhere from 20 to 25 percent of this budget goes to the tech stack. The tech stack is the backbone technology that supports the fintech stack, as we’ve talked about elsewhere.

To truly meet and sustain the new demands of the remote work environment, we’re telling RIAs to plan for a five to 10 percent increase in spending on the tech stack. This is for spending on PCs, laptops, internet and technology, basically anything that you need to make your remote work environment work.

There’s plenty for RIAs to be excited about in 2021 – I know we’re excited about another great year. As we saw last year, the power of a flexible and secure technology platform is realized and becomes a competitive advantage when the risks of disruption to daily operations are at their highest.

I look forward to talking with you more throughout the year about improving your competitive advantage through technology. But if you can’t wait, be sure to check out our inaugural Cyber-Chats podcast, where I talk about what to expect in tech in 2021.

Until next time…

Wes

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Managed Services

Rely on our industry expertise to reduce your IT burden and access the best technology solution to help your business grow.

IT Support and Services

Get your IT questions answered, issues resolved and generally make your workday easier with support from our team. We call this Obsessive Support®.

Protect Your Firm from Data Risks

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

Tax Season Readiness: Implementing the Security Six for CPA Firms