The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

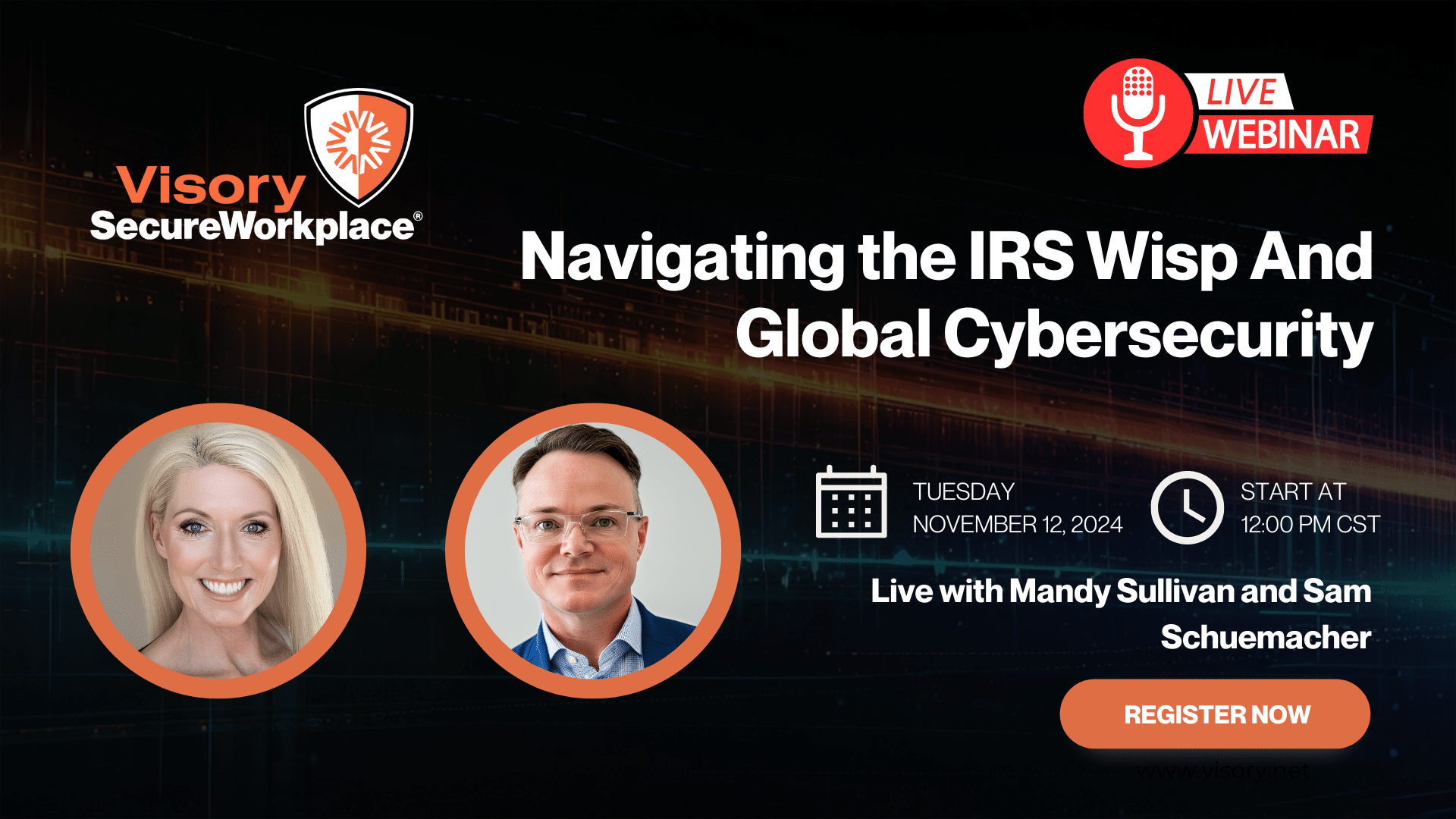

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

It’s been nearly a year of running your business or accounting practice from home. It’s required a lot of adjustments, particularly in the technology realm, as business processes moved to the cloud. Video conferencing, collaboration tools, accounting software — welcome to the virtual world. But in light of news about ongoing hacks in both industry and government sectors, you’ve likely wondered just how secure your new digital workflows really are.

Digital tools and moving accounting workflows to the cloud saves time and money and improves collaboration. There are so many benefits! But there are always potential risks when sharing information electronically. That doesn’t mean you should stay away from digital tools, it just means getting smart about managing those risks effectively.

Staying Secure When Working Remotely

It’s not just large companies that are in the crosshairs of cybercrime. Even smaller businesses are at risk from phishing, malware, and vulnerabilities from connecting remotely by VPN or other methods. For anyone working with customer data and sensitive financial information, knowing best practices to prevent a hack are crucial, both for reputational and compliance reasons.

A good baseline to protect data when using technology to virtually serve clients or manage your books is the IRS Security Six. Following these steps will help you ensure you’re doing all you can when working remotely to ensure sensitive information is never compromised.

This includes using:

- Antivirus software and setting it to automatically update so you’re always current.

- Firewalls that protect your computer or network from malicious or unnecessary network traffic and malware

- Two-factor authentication as an added line of defense

- Backup software/services so you have copies of all your files

- Encryption that turns data on the computer into unreadable files for unauthorized users

- A written data security plan, which is required by the U.S. Federal Trade Commission’s safeguards rule.

What Specific Cyber Threats for Accounting Should You Look Out for?

Accounting cybersecurity is an issue that needs to be continually addressed to keep data safe. Although threats are always evolving, there are several common vulnerabilities you can take steps to protect against.

#1 Phishing, Malware, and Ransomware

An estimated 91% of all data breaches and cyber attacks begin with a spear phishing email with the goal of stealing personal information or tricking you into downloading malware or ransomware or making an urgent payment. Phishing emails often include links to fake websites or attachments that, when clicked, download malware or ransomware onto your computer or network or let an attacker take control of your computer. These emails often appear to come from an official source, like the IRS, a client, a colleague, or a software service you use.

Stephen Lawton, special projects editorial director at cybersecurity information publisher SC Media, told Accounting Today: “Often, the easiest way attackers enter a professional organization is through what appears to be an expected email… It might not be a direct attack against an accountant but rather an emailed ‘resume’ to HR or what appears to be a benign email with no attachments but rather a link to an infected site.”

A few pointers: first, always check the sender email address to make sure the email is from someone you know and trust. Sometimes the email address is obviously fake, other times just one letter or number may be off. Check carefully! Two, always be wary of “urgent requests” and anything that involves payments. Three, if it feels off or seems suspicious, it likely is. Don’t click any links or download files unless you are 100% sure they are legitimate.

The IRS has more information about protecting tax data at home and at work, including against phishing, here.

#2 Outdated Technology

A lot of businesses and accounting firms rely on out-of-date technology. Older technology is vulnerable to attack because software updates and support are no longer available. For example, if you’re running an older version of Windows or Microsoft office, you’re missing out on the latest security. Attackers are much more successful at targeting older systems with weaker security or that have known vulnerabilities. You can defend against this by making sure you regularly update your technology and tools and keep your business running on newer versions. Scheduling regular downloads of security updates not only will make you more secure, but will also help you perform better and be more reliable.

#3 Weak Passwords and No 2FA

Remember to use strong passwords and two-factor authentication (2FA or “MFA” for multi-factor authentication) whenever possible. We all know passwords are a pain to remember, but using “12345” is just asking for trouble. Keep your accounts secure by using a combination of letters, numbers and symbols. Second, most tools, apps, email providers, and other services you use will offer the option to turn on 2FA. Do so! A common type of 2FA you are probably familiar with is a text message or email with a unique code to enter to complete login. Although it’s an extra step, it’s worth it to keep data secure.

Also be careful about how you share login credentials as well as with whom. Not everyone needs access to every file or account. A password management tool, like Lastpass, can help you keep passwords, organized, safe, and accessible to only those who need them. A strong approach to passwords combined with 2FA can be one of the best and easiest defenses against stolen or compromised sign-on credentials!

#4 Lack of Staff Training

One of the best defenses against attack is to train your staff about threats and make sure everyone is aware of security best practices. Expert, third-party security training partners can help make sure your employees have the knowledge and tools they need. For example, you can consider scheduling a day dedicated to cybersecurity education to discuss areas including phishing, physical security, and password security. If you are looking for a training partner, there are many out there, like KnowBe4 and others. Let us know if we can help you find a solution! By empowering employees to understand their role and responsibility, you can significantly reduce the damage that occurs from an incident.

Security for Cloud Accounting

Over the course of the year, you may have switched to hosting QuickBooks or Sage in the cloud to continue running your business or to serve clients remotely. Cloud accounting allows real-time collaboration and access to files so there’s no need to meet in person to sign documents, review files, and more. If you made the switch to hosting, you can feel more confident in your security than otherwise! Many times, cloud hosting providers offer greater security than you could achieve on your own, but only if the vendor takes security seriously.

Here are a few areas you should double-check or ask your hosting vendor about:

- How do you defend against malware and ransomware attacks?

- How often do you back up my data? Do you use SOC 2 data centers?

- Does your solution meet compliance standards, like PCI compliance?

- How do you handle disaster recovery?

- What solutions do you use for firewalls, encryption, and responding to threats?

- How do you handle permission security controls?

- Are you regularly updating your systems and addressing new security threats as they arise?

Whether you’re managing a large construction firm or hotel chain, a growing mid-size business, or are a one-person shop, cybersecurity is a challenging, but critical, area to be diligent about keeping up on as best as possible. Knowledge is power. You are only as strong as your weakest link is especially true with cybersecurity.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

Tax Season Readiness: Implementing the Security Six for CPA Firms

How CPA Firms Can Prepare for the Busy Tax Season