The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

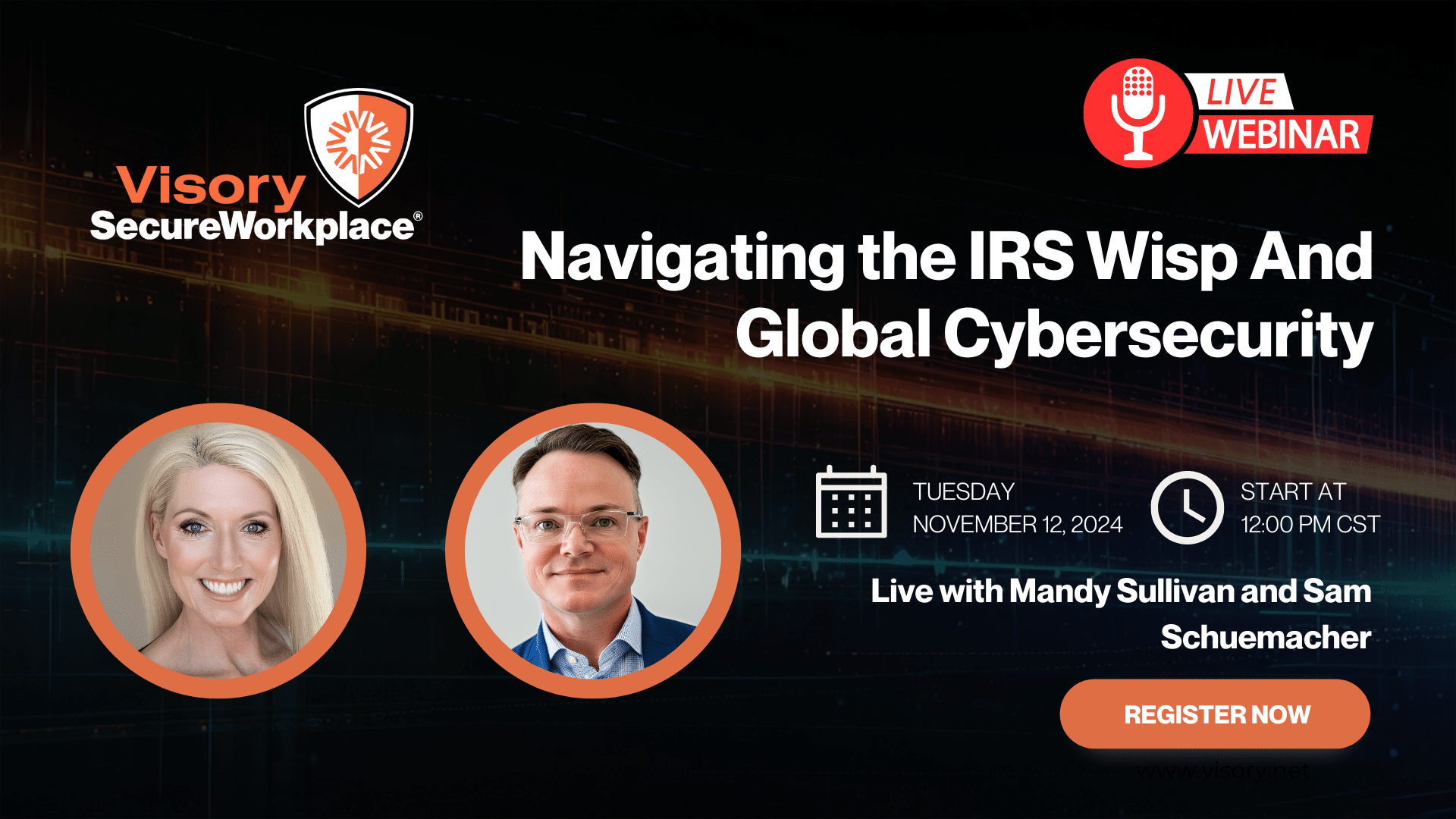

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

It’s no secret that the way accountants engage with their clients has shifted dramatically over the last several years, and for the better. In-person meetings are no longer the norm, and paper documents are also falling by the wayside. Accountants are embracing new technology to be able to interact with their clients because if they don’t, they risk lose clients.

So, today firms now rely on email, video conference calls, document vaults, e-signature tools, cloud-based storage solutions, instant messaging platforms and of course, the telephone. With the landline telephone as the lone possible exception, the channels depended upon most for client communications involve the Internet.

As the range of communication channel options has opened, the frequency of one-on-one client engagements has also risen. With this reliance on the Internet, accountants are now at greater risk for data breaches and cyberattacks and have an increased need for robust cybersecurity management.

The Right Way to Think About Cybersecurity

“Cybersecurity” is not an off-the-shelf product that firms can buy, install, and then move on with other items on the to-do list. Cybersecurity is a 24/7 ongoing process. It’s a collection of policies, products, procedures, training and reporting that’s folded into a firm’s strategic plan and backed by a risk management backbone.

Accounting firms that approach cybersecurity as a ‘to do’ list item rather than as a critical driver of their firm’s risk management strategy have the wrong perspective. Consider: it would be absurd for firms to just purchase and install off-the-shelf tax planning or accounting software and call it a day. Though you may use the software, clients expect a level of insight, tax planning management and financial guidance from you – you have expertise they can’t buy off-the-shelf.

Think of your firm’s approach to cybersecurity management through the same lens. While there are certainly technology tools and applications that are needed, what is even more important is a level of active oversight and expertise about your operations so that your firm’s and clients’ data is secure and protected from cyberattacks and data breaches.

Gain Competitive Advantage Through Reframing Compliance

The cost structure of doing business has changed. Items that were once considered a vital part of the office infrastructure – think conference tables, walls, picturesque views, etc. – have diminished in importance on the accounting firm’s office expenditures list.

In their place, there is now the technology infrastructure that’s needed to run the firm operations and support client engagement – from the office or remotely.

Cybersecurity is about securing the communications and technology that your firm needs to run its business successfully. As the paradigm of work has shifted, accounting firms need appropriate cybersecurity protocols and processes to facilitate the new way of work.

While it’s true that accountants are not beholden to governing regulatory bodies like their peers in other areas of financial services– there are no S.E.C., F.I.N.R.A. or D.O.J. equivalents for the accounting world – like every other business, they must comply with state laws around data privacy.

This means that when there is a data breach, firms are still on the hook. In fact, the lack of proactive monitoring or enforcement of state laws and requirements can increase a firm’s risk of exposure. And when there’s a breach, it’s the cybersecurity insurance group that will conduct the forensics to expose the gaps in your cybersecurity protocols, not your firm’s IT group.

Think it won’t happen to you? Think again. Accounting firms are high value targets for cyberthieves. These bad actors want the underlying client data you possess to do your job. They are after your clients’ IRS forms, they want to change the bank account numbers and the routing information, for example, and they are willing to wait for it. In fact, a recent report from IBM found that hackers will exist on a financial firm’s network for 197 days – watching and collecting information – before anyone inside the organization knows they are there.

One final thought: in addition to taking the right steps to implement a rigorous cybersecurity management program at their firms, accountants must also impress upon their clients the importance of cybersecurity. Since most breaches still start with unprotected clients, accountants would do well to educate their clients in addition to having the processes and protocols in place to be able to handle inbound breaches.

Compliance

Our team of professionals has the right expertise to ensure your technology and cybersecurity complies with the strictest guidance and passes regulatory muster.

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms