The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

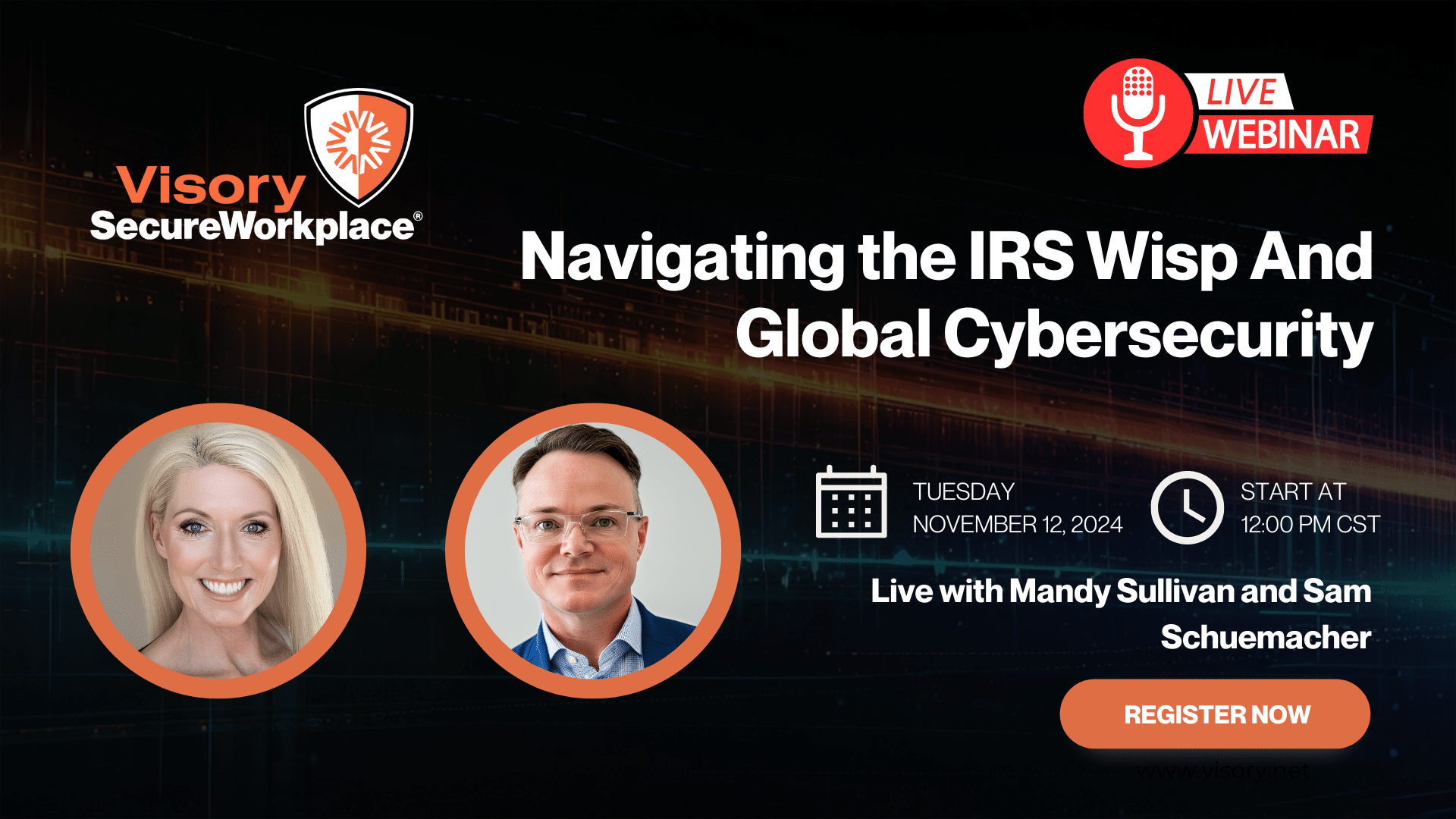

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Getting an audit notice is a nightmare situation for most accounting clients. When opening up the mailbox, they might be expecting a letter from family, a magazine they’ve been waiting for, or an Amazon package. A notice from the IRS is about the last thing anyone wants when they open the mail.

For CPAs, accountants, and bookkeepers, this crisis presents an opportunity. At Swizznet we like to help accounting professionals learn ways to go beyond number crunching to become trusted advisors. Giving clients peace of mind during an audit is one way to go beyond the numbers and provide tangible value.

Here are three ways to boost your practice by offering audit protection.

1) Offer Proactive Audit Protection Services

There’s a gap between people’s perceptions of the likelihood of an audit and the reality of a likely audit. 63% of surveyed taxpayers report that fear of an audit is a significant factor in reporting and paying their taxes honestly, but only 0.15% were audited for their 2019 return.

While the vast majority of taxpayers reported personal integrity as the key driver in filing accurate returns, and 73% said they trust the IRS to fairly enforce tax laws, this still represents an opportunity for accounting professionals to assuage clients’ fears around audits.

For instance, an equal proportion of taxpayers (88%) report consulting the IRS website and paid tax professionals for tax advice and information. This means CPAs can start by communicating the reasons around audits, then easing clients’ fears by proactively guiding them through the process. Clients will gain confidence in taking legitimate credits and deductions they might otherwise forgo for fear of being audited.

A proactive approach need not be limited to tax audit prevention. Given the IRS’s backlog, recent funding cuts, and changing tax codes, accountants can help bring clients peace of mind and reduce frustration by serving as an intermediary with the IRS. They can also help guide clients around state tax filing and audits, which can often be more unpleasant than federal tax audits.

2) Represent Clients During Audits

There’s a misconception among clients that accounting professionals won’t be able to help during audits. The IRS allows any tax professional with a IRS Preparer Tax Identification Number (PTIN) to prepare federal taxes. In addition, it allows CPAs, enrolled agents, and attorneys unlimited representation rights during audits, hearings, document transmissions, and written communications with the IRS.

Circular 230 gives additional rules and guidance for tax advisors. Recent bipartisan legislation proposes to give the Treasury Department authority to regulate paid tax return preparers under the rules of Circular 230. The AICPA supports this move since it will help ensure that tax preparers are competent, ethical, and practice honest advertising practices.

3) Use Technology to Smooth the Tax Process

There’s another misconception that the IRS is behind the times in terms of technology. They may be slow to enact some of the innovations in the private sector, like online accounts and automated callbacks, but the IRS is actively looking to modernize the tax process. For instance, it can receive electronic information from accounting software programs, including QuickBooks and Sage.

This is good news for accounting professionals and clients. Using software and building digital workflows decreases the likelihood of calculation errors, helps track all income, and makes it easy to back up files in case of an audit. Importantly, the IRS requires a copy of the books and records of original entry, not a downloaded Excel file or other methods of recreating the original files.

Instead of having to print and mail these files, accountants and clients can simply create a backup copy of the original files with a temporary password then switch back to the original password within the main files. Both QuickBooks and Sage include other features that make the auditing process more efficient, including automatic payroll tax form completion and third-party integrations.

Swizznet’s Tax Hosting Service

To make the entire process simpler and more efficient, you can combine the power of your tax software with QuickBooks or Sage through the cloud with Swizznet’s tax hosting service. Swizznet handles all the headaches associated with IT, so you can focus on growing your business.

To learn more about our tax hosting service, contact us to talk with our Obsessive Support® team. We promise you’ll leave with a smile on your face.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms