The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

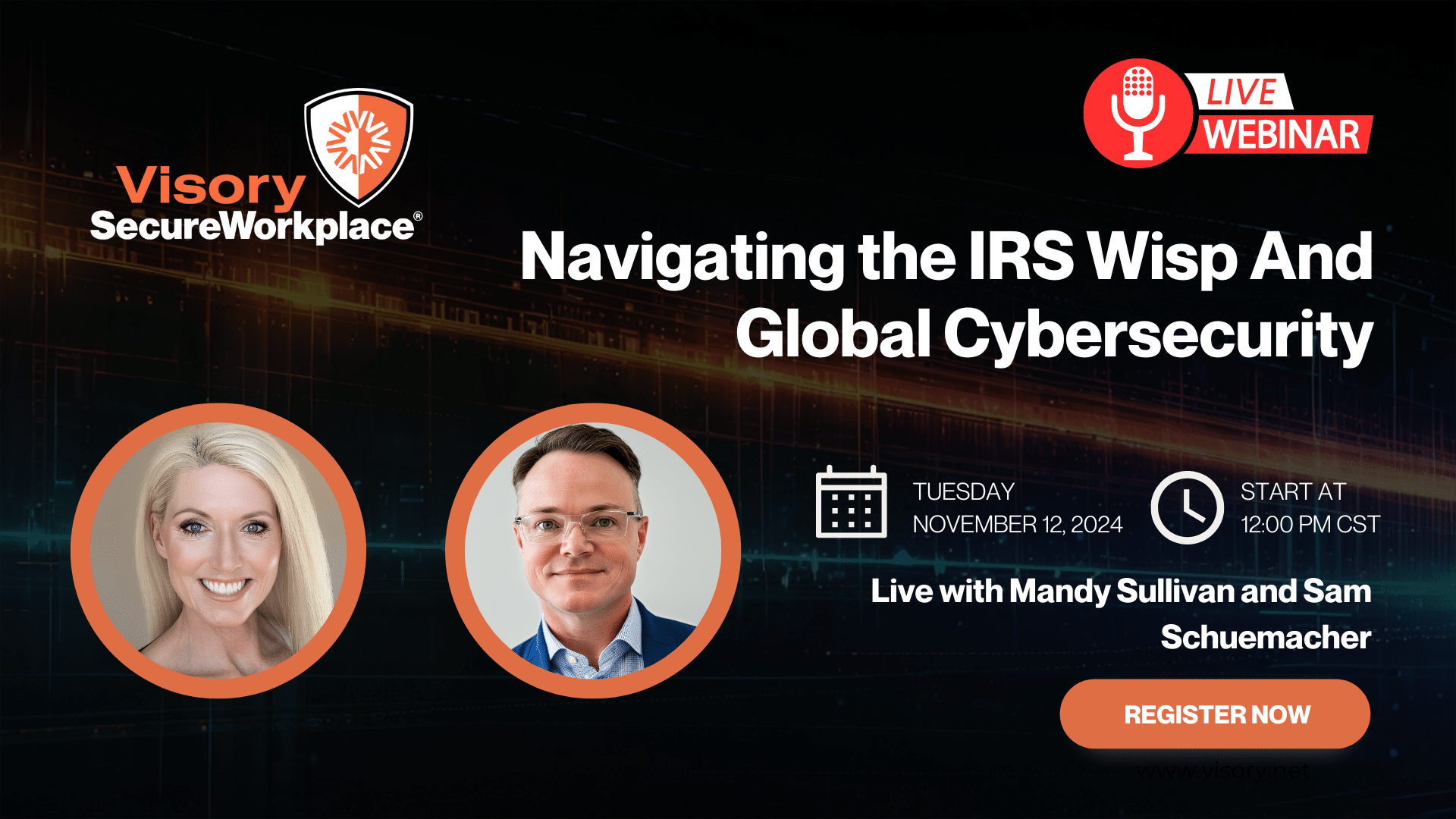

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

We’re kicking off accounting’s favorite time of the year: tax season (cue the memes). Accountants aren’t the only busy people. The financial data surrounding returns makes the industry a prime target for cyber criminals.

Bad actors are evolving their methods. Modern attacks range from calls from fake IRS agents, to spear-phishing emails that trick recipients into downloading ransomware. The goal of these attacks is often to steal identities, submit fraudulent returns, and collect refunds.

Even smaller firms have access to sensitive data of high net worth individuals, so it’s critical for all accountants to create a tax season security plan. In this post, we’ll cover the most common vulnerabilities to be aware of while preparing and filing taxes, and introduce ways to utilize your technology and human capital to prevent data breaches.

Understand the Ways Cyber Criminals Try to Swindle Consumers

Phishing, and Its Variants

You’re likely familiar with phishing emails: ones that appear to come from a legitimate sender like “IRS Tax E-Filing.” Most phishing emails are caught by spam filters, but professional cybercrime gangs use social engineering to mount personalized, effective phishing attacks on high-value targets.

This directed form of attack is known as spear-phishing. It has worked even on behemoths like Facebook and Google, who were duped out of $100 million between 2013 and 2015 (CNBC). Spear-phishing attacks can attempt to scam accountancies, businesses, or individuals by tricking them into transferring money to the scammer. They can also be part of identity theft schemes by tricking tax professionals into verifying their EFIN and CAF numbers.

Voice-related phishing (“vishing”) is also on the rise, with 400 vishing scams reported in 2020 (IRS). While phone-related tax scams are overall on the decline, the IRS cautions that it generally contacts people first by mail and will never request personal information by email or text.

Ransomware: One Click Away

Ransomware attacks continue to rise across various sectors including governmental entities and financial institutions. The goal of these attacks is to encrypt data on the target’s systems and require a ransom to restore access. Ransomware typically infects systems through links in phishing emails. Swizznet recently saw such an attack firsthand in a state-based construction company client.

Two Attack Methods, One Common Trait: They’re Easier to Prevent Than Clean Up

Each of these attacks sound simple enough to avoid, but they are lucrative ways for bad actors to breach their targets’ data and infrastructure. Companies who are hit with ransomware attacks often pay the ransom rather than risk losing sensitive data and damaging their reputation. The most common ransomware payment was $10,000 in 2020 (Sophos).

Both phishing attacks and ransomware take advantage of weak systems and human mistakes, so a tax season security plan requires securing technology and training human resources to recognize these attack methods.

Secure Your Technology

Securing data used to mean locking files up in a cabinet inside a secured office. With remote work becoming mainstream, tax information is increasingly dispersed. Team members often use the same device for personal and business activities. This makes it imperative to develop and enforce policies around mobile and BYOD devices. This includes:

- Keeping software updated on all devices

- Backing up critical files and software on computers and hard drives

- Encrypting drives so only authorized people can access sensitive information

- Using applications with built-in partitions from the rest of the device

- Using anti-virus software and firewalls

- Establishing a virtual private network (VPN) for colleagues and clients to use while collaborating remotely

Technology companies are creating sophisticated solutions that combine financial data in a single source of truth, as Wes Stillman, Founder of RightSize Solutions, recently shared on Swizznet’s blog. But often the weakest link is the humans that prepare and submit returns. Let’s explore how to incorporate humans into your tax season cybersecurity plan.

Build a Human Firewall

It may seem impossible to train employees to become part of your cybersecurity defenses. The good news is they don’t need to become experts to play a useful role. It’s key that they understand the most common threats and vulnerabilities in their remote workflows, such as knowing how to spot phishing attacks and avoid downloading ransomware.

Access-based controls are another layer of the human firewall. Develop and enforce policies around strong passwords and multi-factor authentication.

Finally, onboard a dedicated cybersecurity professional, or form a relationship with a cybersecurity firm. Accountants need not take the place of cybersecurity professionals. These professionals can develop customized protocols then enforce them throughout the organization.

SwizzStack: Swizznet’s Contribution to Tax Season Cybersecurity

All this may sound overwhelming — we get it. Security challenges are heating up at the same time as organizations are struggling to fill positions. Who has the time?

After years of hosting QuickBooks and Sage software on the cloud, Swizznet began to see a need among accountants and accounting clients for a more comprehensive solution to their IT needs. One they can rely on for their accounting software as well as broader IT support.

We responded by developing SwizzStack, a full stack of services that includes everything you need to run your IT infrastructure no matter where your team members and clients work. SwizzStack includes our leading cloud hosting for QuickBooks and financial applications.

We customize a cloud environment based on your requirements, all backed with our bank-grade security. Unlike some other options, we host the full desktop version of QuickBooks using Citrix which gives you the same experience you’re used to on desktop.

It’s backed by our 24/7 Obsessive Support® which is available to help with all your IT needs.

If you’re interested in learning more about the security threats facing accountants, CPAs, and bookkeepers, take an in-depth look in this eBook, which you can download here.

Compliance

Our team of professionals has the right expertise to ensure your technology and cybersecurity complies with the strictest guidance and passes regulatory muster.

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms