The hallmark of the Visory experience, our dedicated team of professionals provides a high degree of support for all your IT needs

Leading edge solutions that are always working to maintain the integrity of your firm’s IT backbone

Best in class security to protect your firm’s data and technology

Tips, advice, and industry insight from our team of accountants and business owners to yours.

Bypass the wait time and access Visory’s Obsessive Client Support®

Take your business to new heights with Visory’s flexible QuickBooks hosting solutions

The same Sage you work in every day, only better

An affordable CRM for small- and medium-sized businesses, built to support your sales, marketing and customer service needs

Revolutionize your next tax season with added efficiency and mobility

Access critical applications that are integrated seamlessly into your workflow, conveniently hosted on the same server

Access affordable enterprise-grade hosting solutions with none of the IT burden

We’ll help you develop and implement the right cybersecurity policies and protocols to keep your firm secure and in compliance with regulatory guidance

We’re here to manage your firm’s IT activity, safeguarding the integrity of your infrastructure and devices, so you don’t have to

Our dedicated professionals can be your outsourced IT team, so your internal resources don’t have to bear the burden of uptime alone.

We’ll manage your cybersecurity policies and protocols to keep your firm secure and in compliance

Security that ensures everyone granted access is who they claim to be

Educate and train your most important last line of defense – your people

Protection where people and their machines intersect

Secure access to your data. Reduce the risk of compromise, prevent cyberthreats.

A different approach to protecting emails

Secure single sign-on access for a connected world

Backup your data for business continuity and compliance

Keep everyone on the same page. Any user, every device.

Secure connections for all your users, devices and networks

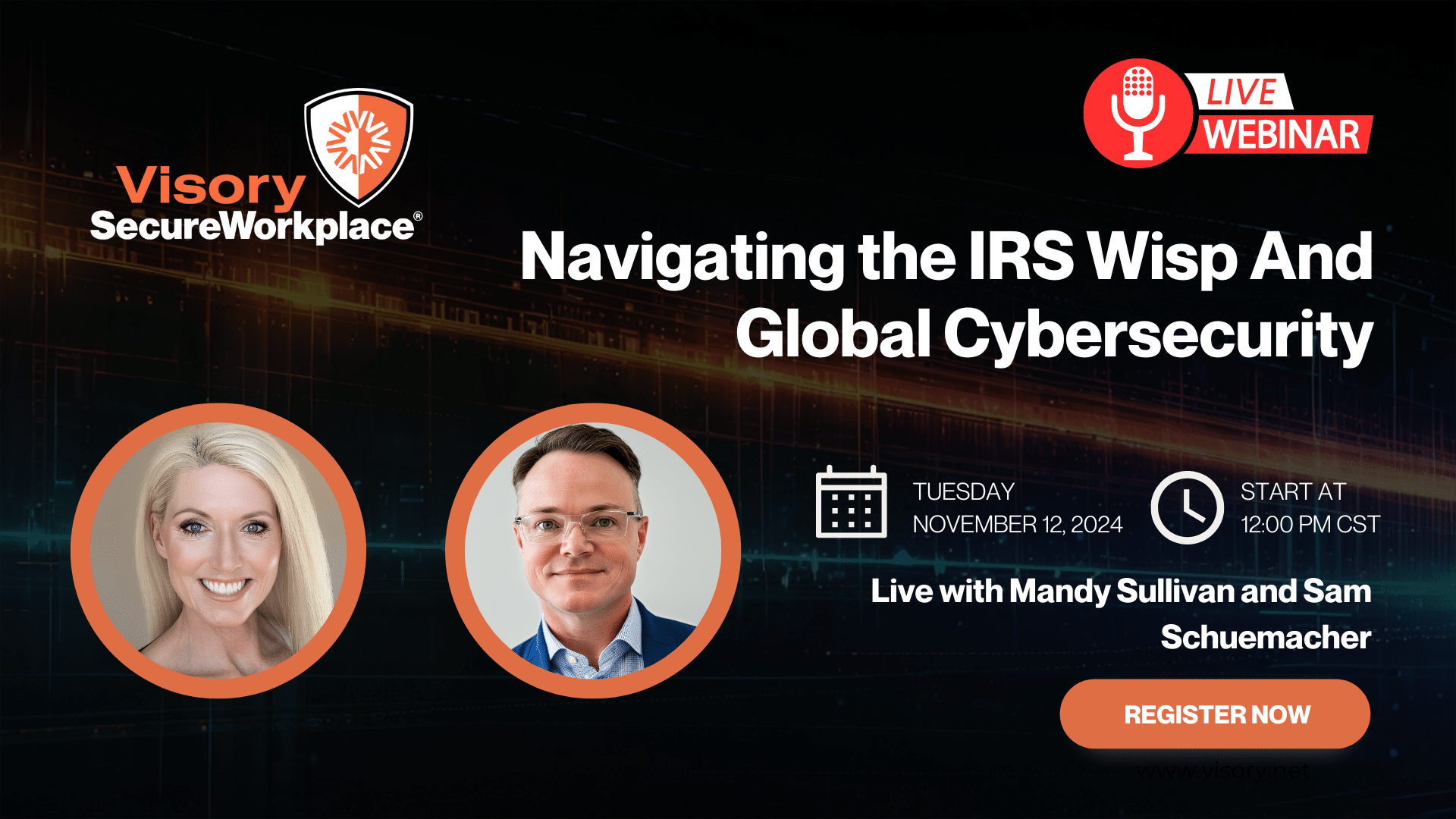

Get started on a robust security plan with a WISP for your business

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

IRS 4557 and the FTC Safeguards Rule

Complying with state and federal privacy regulations and more

Get started on a robust security plan with a WISP for your business

Educate and train your most important last line of defense — your people.

Protect your organization with the expertise of our Chief Information Security Officers (CISO) without having to hire a full-time resource

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy

Based on what we see happening in the RIA industry, we expect 20% of financial advisory firms will have some type of security breach from an outsider this year. With investor protections as their foremost concern, no wonder regulators are asking independent registered investment advisors (RIAs): how ready are you for a security breach?

Cybersecurity readiness encompasses a firm’s plan for prevention, investor protection and breach management. At its best, cybersecurity management is a three-legged stool, with equal attention and care given to technology, policies and people for optimal results.

Technology: The Starting Point

Cybersecurity management starts with having the right technology in place to prevent or sidestep disaster. Regulators want to see the kinds of firewall protections RIAs have in place, the usage of passwords and encryption, and whether advisors are using tools like multifactor authentification.

Technologies like firewall hardware and software, antivirus, anti-spam, content filtering, malware software and the like are foundational and mandatory. They identify issues based on what is already known about cybercrime and hacks — including ransomware — and have a huge role to play in prevention.

RIAs should minimize the number of passwords that employees need and consider using password vaults to help them do so. There should be encryption technology in place for email communications and file access. Firms that use cloud-based document vaults for file sharing with clients should take a multi-factor approach by encrypting files prior to putting them in a cloud vault.

Mobile devices used for business purposes, including phones, laptops and tablets, need to be secure and “dumbed down” with limited access points into the firm in the event the device is lost or stolen. The alternative — an older, but nevertheless well-tested option — is to have a policy requiring users to have separate devices for their own personal use, and not for the business of the firm or its clients.

Policies: Managing What You’ve Got

With the right technologies in place, regulators want to know how RIAs monitor and manage them. Firms need enforceable policies and procedures that reduce the frequency of system issues and improve resiliency when issues do happen.

Good security protocol means backing up the firm’s data frequently, and knowing what the data back up to. It means running and reviewing reports and periodically testing backups to ensure they will work in a crisis.

Technology management and oversight also extends to the firm’s external technology providers. According to regulators, RIAs are responsible for knowing what their technology vendors do with their data, and whether their procedures would pass an audit. This includes doing due diligence on the vendor’s procedures for keeping the firm’s data safe from external breaches and for protecting it from internal sources. For example, what if a vendor encrypts viruses? If the vendor or application provider is doing backups, advisors need to know when the backups are done, who has access and how to get data back should they decide to switch providers.

People: The Weakest Link

The reality is that having technology and corresponding security policies in place is not enough. It is critical that the RIA’s people articulate, embrace and practice them. Human awareness is typically the weakest leg of the cybersecurity management stool, and it can cripple the other two legs.

The financial advisory industry generally has a naive attitude about cybersecurity, unaware of the far-reaching impact of its actions. They want to use personal mobile devices for work and vice versa, and can view mandatory passwords, firewalls and the like as obstacles, instead of protections in place for their own benefit. And why not? Anytime, anywhere on-demand access is expected in our society. Without the right training, advisors cannot expect their staff to think differently than anyone else.

RIAs need to provide their staff with awareness training and regularly update and review the firm’s security policies. Firms need to bring their technology protocols to life, and monitor to ensure all users comply. Staff also needs to understand the firm’s contingency plan in the event of a cybersecurity event or other business disruption, and how this plan is executed.

Advisors may not have the ability or inclination to do all of this internally, so finding a trusted partner (or partners) who understands industry regulations and how they translate into appropriate policies and solutions is key. For example, RIAs may want the help of a compliance officer to develop key documents. They may want objective advice about their technology options, and what makes the most sense for them. The Threat Is Nearer Than You Think

Hackers are looking for big payoffs for little effort, and the financial advisory industry seems to deliver. RIAs in particular can be slower to embrace new technology, have relatively lax cybersecurity policies, and control or have access to large amounts of assets, approaching or passing the billion-dollar mark in many cases.

But security breaches do not always originate from the outside, nor are they always intentional. The U.S. Federal Deposit Insurance Corp. (FDIC) breach happened in 2015 when an employee downloaded 44,000 files on its bank clients’ bankruptcy plans onto a USB thumb drive and then quit. Phishing emails have gotten more sophisticated, and following directives or clicking on links from suspicious emails is still commonplace.

Any simple, unexpected event has the potential to disrupt a firm’s business. Human error, a network or computer failure — the internet goes down — can trigger a business disruption that requires a well-thought contingency or security plan to kick into place.

Act Now

It is time for advisors to act against cybersecurity threats for the sake of their clients and for their firms. Wealth management firms are in the crosshairs for cyberthieves, and it is a question of when, not if, firms get hit.

The best approach combines the latest preventive and predictive technologies; well thought, enforced security policies and protocol; and awareness training to foster a sustainable cybersecurity culture in the firm.

RIAs that do nothing — or do not try — will be penalized by regulators. These firms are also leaving doors wide open with welcome mats for hackers and cyberthieves seeking access to client data and assets.

Compliance

Our team of professionals has the right expertise to ensure your technology and cybersecurity complies with the strictest guidance and passes regulatory muster.

Cybersecurity Solutions and Services

Active monitoring and implementation of cybersecurity protocols and procedures using leading edge technology keeps your business and your data safe and secure.

Protect Your Firm’s Future: E-Guide on Cybersecurity and Managed IT for RIAs

Year-End Housekeeping for Accountants

IRS WISP Compliance Resource Hub

Tax Season Readiness: Implementing the Security Six for CPA Firms